Are We Heading Into a Recession And What Can Businesses Do About It?

The economy of the United States has been growing steadily since the great recession, but there are other factors that have to be taken into account when considering if we are headed into another recession. The rest of the world is not doing well, and this is having an effect on the U.S. economy.

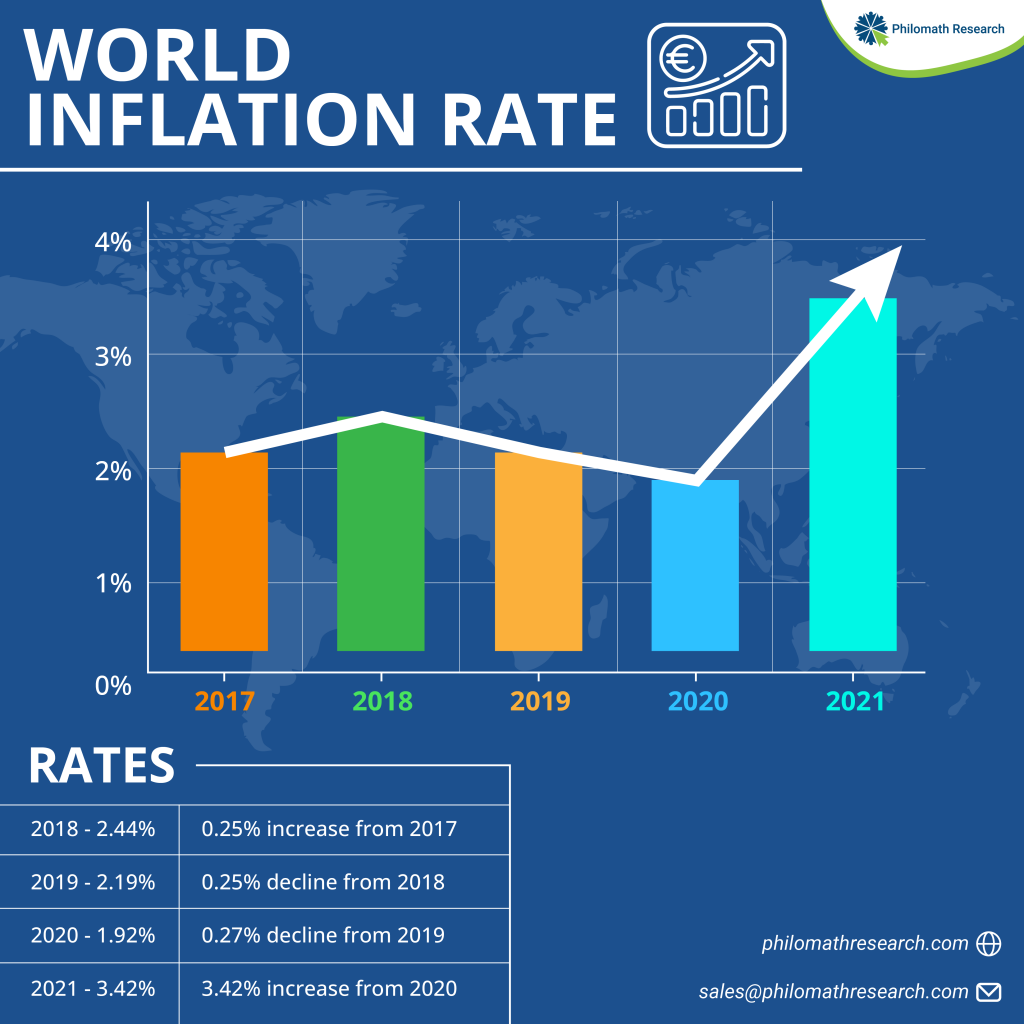

The global headwinds have been strong throughout 2022. Inflation has been a main concern for all economies worldwide, albeit, to a varying degree. Central Banks have been forced to ramp up their efforts to get inflation under control. Rising energy prices, food shortages, supply chain woes, and increasing raw material prices are only exacerbating an already fraught situation.

Towards the end of 2022, there were major layoffs in global technology companies, a trend which has continued in to 2023 as well. Central banks, globally, have been tightening the money supply to curb inflation, which has increased the cost of borrowing, venture capitalists who were funding start ups through their cash burn are now pursuing profitability and the post pandemic sense of euphoria of rising demand has dampened if not completely fettered out.

This begs the question, what is inflation and what has been its cause.

Inflation is the rate at which the general level of prices for goods and services rises. It is measured as an annual percentage increase. When prices rise, each unit of currency buys fewer goods and services; consequently, inflation reflects a reduction in the purchasing power of money – a loss of real value in the medium of exchange and unit of account within an economy. Simply put, inflation is the percentage by which goods and/or services become expensive every year.

A little inflation is good, it shows that the economy is growing and the demand for goods and services is rising. It becomes challenging when it rises beyond a certain threshold. It leads to a decrease in the living standard, diminishes the purchasing power and lowers the discretionary spending for an individual or an economy as a whole. It is for this reason that policy makers and central are focussing on controlling inflation. As per the World Economic Forum, inflation has become the no. 1 concern, surpassing both the pandemic and the war in Ukraine.

(https://www.weforum.org/agenda/2022/10/global-concern-inflation-energy-economy/)

During the pandemic, there were lockdowns in most major economies around the world. As soon as these lockdowns were lifted, there was surge in demand, people who had been in their homes all this while, wanted to travel, eat out, shop more etc. There was also a looming fear that these lockdowns could potentially cripple economies, so the central banks followed quantitative easing, printing more money in simpler terms. It was easier to get credit and many nations provided financial help directly to citizens by way of bank transfers into their accounts. This helped demand recover which had slumped during the lockdown. Brent Crude, which had very briefly, traded in the negative, was recovering to the pre pandemic levels. While all this demand had been going up, the supply chain, had not recovered completely. With more demand than supply, the inflation began to creep up.

We had just put the pandemic behind us and were hopeful for a world which was better, more normal than what it had been after Covid 19 locked us inside of our homes, Russia began the invasion of Ukraine. This led to a further increase in the price of oil, food shortages that affected all major economies in the world and energy prices (including natural gas) were spiralling out of control. Europe, which is heavily dependent on cheap Russian gas, has seen their heating bills sky rocket this season.

With so much pressure on our finances, as citizens, we had to make choices about where to spend our money, what to buy, and what to defer. Coupled with this, there have been layoffs in big companies which has further tightened the purse strings of many households. Even companies which were chasing expansion fuelled by cheap debt, are now reigning in their expenses and are busy charting out plans for profitability.

Another key aspect of inflation is slow economic growth. As households have less and less money to spend, they will prioritise their expenses and more discretionary spending will be deferred till the economic outlook improves. In an uncertain economic environment, they will be focussing on saving whatever they can, rather than spending it.

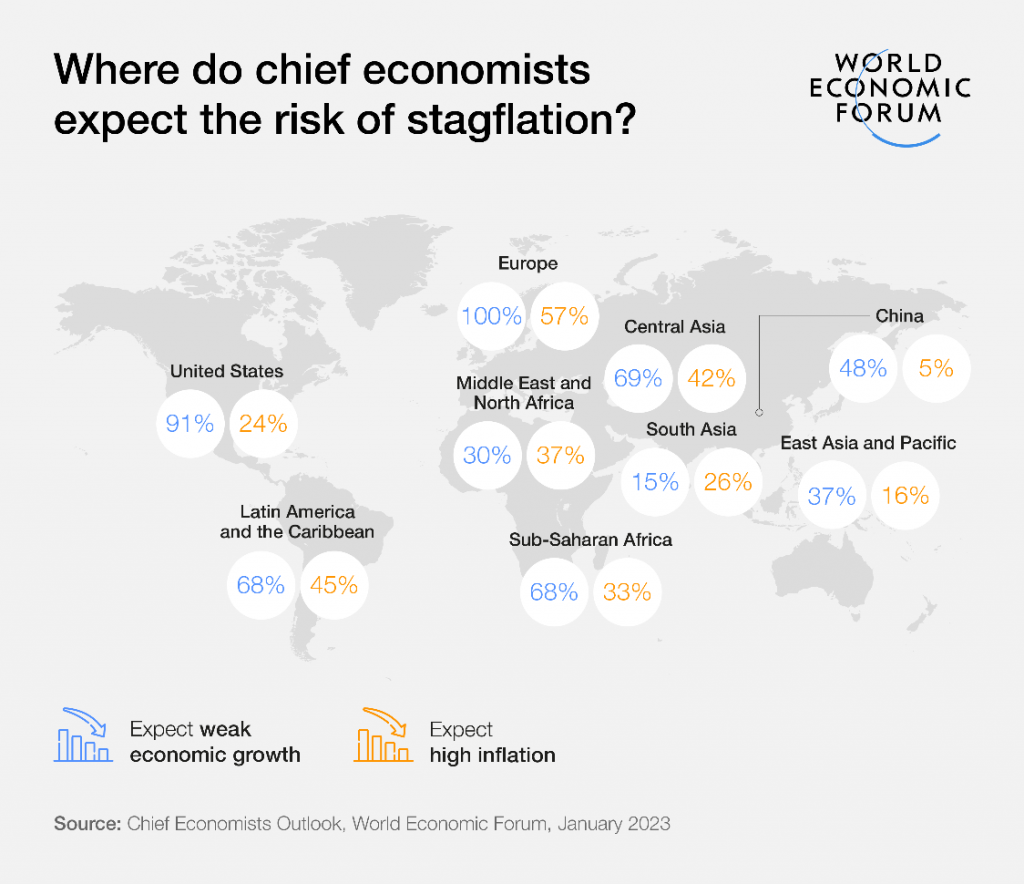

The World Economic Forum forecasts that the global growth will slow down to 2.7% in 2023 from 6.0% in 2021. With the exception of the pandemic, this is the slowest since the global financial crisis. In the United States, 91% chief economists feel that the economic growth will be weak in 2023. This number goes up a 100% in Europe, 24% of chief economists feel that inflation will rise in the United States in 2023 and in Europe, 57% share this view.

There is a silver lining though with several experts indicating that the inflation should be tamed in 2023, however, we will only know as the year progresses.

Erik R. Peterson, Partner and Managing Director, Global Business Policy Council at Kearney has a relatively optimistic response to this question. “Traditional economic theory holds that inflation is actually a good thing when appropriately contained and that ‘killing’ it would be less economic than merely ‘wounding’ it by bringing it down to a manageable level,” he says.

“To be sure, it is critical for central banks to arrest the current high rates of inflation, but the prospects are that price pressures (accelerated by aggressive tightening by central banks) will dissipate significantly this year. Policymakers are well aware that the trade-off in addressing inflation is foregone growth and perhaps even recession in the short term, and the optimal outcome would be a ‘soft’ landing.”

(https://www.weforum.org/agenda/2023/01/inflation-in-the-spotlight-chief-economists-outlook/)

Inflation can be killed without causing a recession, but history shows how difficult this can be to achieve, adds Ira Kalish, Chief Global Economist at Deloitte Touche Tohmatsu. “For this to happen, there would have to be factors other than tightening of monetary policy to help stifle inflation. The best hope for this scenario is in the US, where inflation is already decelerating largely due to an improvement in supply chain efficiency and declining energy prices. Although monetary policy has tightened substantially, the US economy has remained surprisingly resilient, with both consumer spending and business investment relatively immune to higher borrowing costs. It is possible that the US will avoid a recession in 2023 and still get inflation down to the desired level. This is not, however, a likely scenario for Europe, where a combination of monetary tightening and energy shocks make a recession almost inevitable in 2023.

“Meanwhile, the 2% target remains in place for major central banks. While an argument has been made to adjust the target given tight labour markets and shaken global supply chains, doing so would likely shock financial markets and reduce central bank credibility. This, in turn, would probably lead to much higher borrowing costs, thereby stifling recovery.”

Is there going to be a recession?

A recession is a period of downturn in economic activity. Recessions are typically announced after understanding the economic data over a certain, fixed period of time and mostly have definite start and end dates. In USA, the National Bureau of Economic Research determines when the economy is in a recession and when the recession ends.

We are likely heading into a recession. Whether we will actually be in one, we’ll have to wait and see. The ones in the know are quite certain that 2023 could very well be a year which sees several economies around the world face a recession.

That being said, what is abundantly clear is that the economic activity is going to slow down across the board. Businesses globally are going to potentially see a downturn in demand of their products or services and could be required to take harsh steps to maintain profitability (as we can see with a slew of layoffs recently).

The Chief Economists Outlook, World Economic Forum, January 2023, indicates that

- 91% of the participants expect demand to be weak in 2023.

- 86% of them anticipate that business will cut operational costs.

- 78% of them anticipate that business will reduce cost by laying off workers.

- 87% of them expect the cost of borrowing to remain tight.

What can we do?

Recession represents a profound challenge for business owners. During a recession there is immense focus on profitability and expected ROI but as the demand recovers, they are challenged with pivoting to a more aggressive strategy.

Focussing on some key areas could be highly beneficial when faced with reduced economic activity or a downturn:

- Revenue, Revenue, Revenue: It is imperative that during such times, businesses focus on generating more and more revenue. Out of their gamut of products and/or services, they should identify the ones which will drive revenue and growth in the long term and have unwavering focus on these.

- Nurture your customers: Connect with and listen to your customers and supporting them during these times will pay rich dividends later. Maintain your customer relationships and stand by them during their difficult times. A good customer in bad times is a great customer in good times.

- Cash Reserves: There is no better friend to a business than cash in the bank. Cash reserves are instrumental in tiding over hard times. As a business owner, you must ruthlessly remove all expenses that are unnecessary. Look for operational efficiencies, remove all bloat from your processes and your business will have a better chance of survival. For a small or medium size business, cash flow is immensely valuable.

- Technology: Evaluate your business to understand where technology can either improve efficiency or reduce cost. Work with your employees, understand their pain points and find out areas where an investment in technology can save you time and costs. This will also give time to your employees to focus more on tasks that are essential to the survival of the business.

- Communicate: Communication is essential during such times. You can turn to them for ideas on savings or finding a new profitable product or a service. Keeping them apprised about how the business is doing will also instil a sense of ownership and belonging in them.

- New Opportunities: It is common for businesses to look inward during a recession, however, as a business owner, you should try to think of innovative products or offerings, or look for businesses that will strengthen your portfolio, expand or diversify your offerings. A recession could potentially present a great opportunity for mergers and acquisitions as many companies are consolidating during this phase.

- Be Prepared: Like all things in life, the recession will not last forever. You must think long term and prepare your teams to be successful when the recession is ultimately over. Demand for your products and/or services will eventually pick up and you should be prepared to service that demand. It could be catastrophic to first lose customers to a downturn and later to their inability to service increased demand.

We hope you enjoyed reading this blog post. If you have any questions or concerns, please feel free to contact us at www.philomathresearch.com